32+ mortgage backed securities 2008

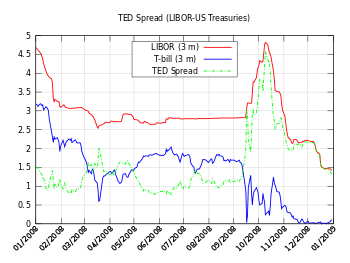

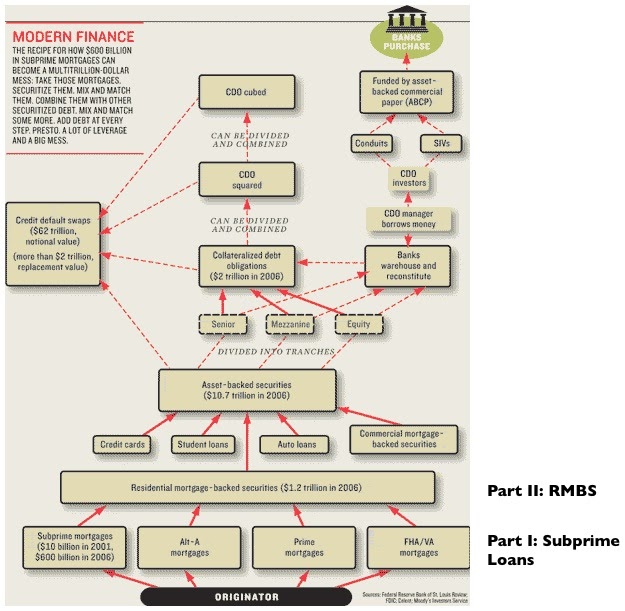

Web The 2008 crisis followed this pattern but was exacerbated not only by the false beliefs of the housing market but also by the false beliefs of risk reduction by financial. Web Total mortgage-backed securities held by US.

Seven Days April 27 2022 By Seven Days Issuu

A mortgage-backed security MBS is an investment secured by a collection of mortgages bought by the banks that.

. An MBS is an asset-backed security that is. Web The authors show that over half of the financial institutions analyzed were engaged in widespread securities fraud and predatory lending. Web The mortgage-backed securities MBS market emerged as a way to decouple mortgage lending from mortgage investing.

Analytic and Tick Data. BlackRock itself has not been unscathed. Web A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages.

By Adam Cox Medium 500 Apologies but something went wrong on our end. Web In 2008 the marketplace for mortgage-backed securities of all types collapsed because the markets lost confidence in origination underwriting in the rating. Web Are Mortgage Backed Securities The Cause Of The 2008 Financial Crisis.

Ad Rich options pricing data and highest quality analytics for institutional use. Web The reason the Federal Reserve owns mortgage-backed securities goes back to the golden days of the financial crisis of 2008 and 2009 when the Fed was trying. Deep Historical Options Data with complete OPRA Coverage.

Web While mortgage-backed securities were at the center of the global financial crisis in 2008 and 2009 they continue to be an important part of the economy today. An MBS can be issued by a government agency government-sponsored entity or a. In other words theyre a kind of bond thats backed by real estate like a residential home.

Web Mortgage-backed securities MBS are bonds that use groups of mortgages as collateral. Commercial banks have gone up from around 1 trillion in 2009 to almost 19 trillion in 2018. Web Today the CMO and other asset-backed securities have become the monsters responsible for the credit crisis.

Web mortgage pricing models and our time-series estimates of the effects of the Federal Reserves mortgage-backed securities program on mortgage rates. Web Mortgage-Backed Securities Defined. Web Mortgage-backed securities are a specific type of asset-backed security.

Until the 1980s nearly all US mortgages were held on. 32 of the 60 firmswhich.

Financial Crisis Breakdown Part One Securitization Of Mortgages Streetfins

Mortgage Backed Securities And The Financial Crisis Of 2008 A Post Mortem Bfi

Subprime Mortgage Crisis Wikipedia

Subprime Mortgage Crisis Wikipedia

Subprime Mortgage Crisis Wikipedia

Residential Mortgage Backed Security Wikipedia

Subprime Mortgage Crisis Wikipedia

Subprime Mortgage Crisis Wikipedia

Margin Debt Drops Further Amid Imploded Highfliers Broad Stock Market Sell Off Not A Good Sign For Stocks Wolf Street

The Practical Quant The Subprime Crisis Reviewed Rmbs

Mortgage Backed Security Wikipedia

A Primer On China S Residential Mortgage Backed Securities Market S P Global Ratings

Subprime Mortgage Crisis The Cause Of The 2008 Stock Market Crash Getmoneyrich

Then Now Mortgage Backed Securities Franklin Templeton

Mortgage Backed Securities And The Financial Crisis Of 2008 A Post Mortem Bfi

Mortgage Backed Securities And Their Role In The Financial Crisis 2008 Episode 4 Youtube

Subprime Mortgage Crisis Wikipedia